What eSIM means for rural carriers today

This article was originally written for the Competitive Carriers Association.

eSIM has been around for a while and adoption in the U.S. and worldwide has been slow, but things have started to change in the last couple of years. Based on a recent report by the GSMA, by the end of 2020 there were 175 carriers in 69 countries that support eSIM – a threefold increase compared to 2018.

There are a growing number of eSIM devices commercially available today including flagships from leading device manufacturers like Apple and Samsung. The GSMA forecasts that by 2025, there will be 2.4 billion smartphones connected by eSIM representing over one-third of all connections globally. In the U.S. this goes up to 52%.

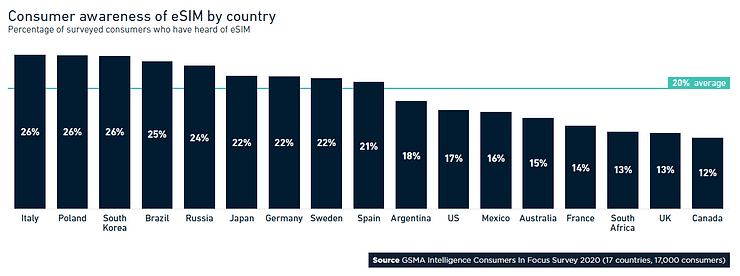

In the U.S., big national carriers like AT&T, Verizon, and T-Mobile all support eSIM; however, global consumer awareness of eSIM is 20% (in the U.S. it is 17%). Why would a carrier – especially a rural carrier going head-to-head with bigger competitors – want to support and promote eSIM to their customers

There are multiple benefits to supporting eSIM, not least of which is easily acquiring new subscribers through digital channels. Traditionally, customers would visit a local store to choose and activate a plan; however, eSIM takes this process entirely online. Through a mobile app or web portal, customers can browse plans, register, pay, and activate their plan anytime, anywhere. A 2020 survey by Capgemini found that 46% of consumers are open to activating mobile services using eSIMs, rather than visiting a store to activate a physical SIM card.

eSIM also expands the distribution model of carrier offers. With physical SIM, cards must be manufactured, shipped, and stocked at multiple points-of-sale. With eSIM, there is no physical distribution. Instead, the carrier's eSIMs (otherwise known as Profiles) are stored in a secure database called a Subscription Manager (SM-DP+) and downloaded to the device during the activation process.

And thanks to eSIM, carriers can choose a variety of ways to sell their eSIM plans. Physical and digital QR code vouchers provide an experience similar to the physical SIM experience but without the supply chain logistics; however, this is not the digital user journey that customers are demanding.

A true digital eSIM customer experience is one where no QR code has to be presented and scanned. Ideally the carrier app is installed on the device and manages the download of an eSIM Profile. At the same time the app can handle the rest of the user journey like browsing plans, registration, payment, and more.

A true digital eSIM customer experience is one where no QR code has to be presented and scanned. Ideally the carrier app is installed on the device and manages the download of an eSIM Profile. At the same time the app can handle the rest of the user journey like browsing plans, registration, payment, and more.

The key is to shift your customer acquisition strategy to meet customers where they are instead of forcing them to come to you. eSIM is critical to unlocking this potential.

Device OEMs are also shifting to an eSIM-only model, removing the physical SIM slot to make space for other components, bigger batteries, or make smaller and thinner devices. GSMA shares that 40% of carriers expect the transition eSIM-only phones to start in 2022. We have already seen the first eSIM-only device with the Apple Watch LTE and the first eSIM-only phone with the 2019 re-issue of the Motorola RAZR. It’s only a matter of time before more devices follow suit. Ultimately this means that any carrier not supporting eSIM stands to lose market share.

By launching support for eSIM and meeting Consumer demand for digital customer experiences and the latest eSIM-enabled devices, rural carriers can increase both their reach and appeal in today’s increasingly competitive marketplace.

COVID-19 and the connected telco consumer, Capgemini